The Invisible Chains: Overcoming Procrastination in Fitness and Finance

Many men strive for physical strength and financial security, yet find themselves caught in a frustrating cycle of procrastination. The desire is there, but the consistent action often isn’t. Whether it’s putting off that workout, delaying a budget review, or postponing crucial financial decisions, procrastination can silently erode progress and confidence. This article will guide you through understanding the roots of this common challenge and provide a robust framework to build an unshakeable mindset for consistent action in both your fitness and financial journeys.

Understanding the Procrastination Trap

Procrastination isn’t merely laziness; it’s often a complex psychological response. For men, societal pressures to be strong, capable, and in control can amplify the fear of failure or the burden of perceived inadequacy, leading to avoidance. Common triggers include:

- Fear of Failure or Success: What if I try and fail? What if I succeed and the expectations increase?

- Lack of Clarity: Vague goals like “get fit” or “save money” lack a clear path, making it hard to start.

- Overwhelm: Large tasks can seem insurmountable, leading to paralysis.

- Instant Gratification: Our brains are wired for immediate rewards, making long-term goals less appealing.

- Perfectionism: Waiting for the ‘perfect’ time or plan can prevent any action at all.

Cultivating an Unshakeable Mindset

Beating procrastination starts internally. It requires a shift from reactive avoidance to proactive engagement. Here’s how to build that resilient mindset:

1. Define Your ‘Why’ with Precision

Before you lift a weight or scrutinize a spreadsheet, understand the deep-seated reason behind your goals. Why is fitness important to you? Is it for health, energy, self-esteem, or to be a role model? Why is financial stability crucial? Is it for freedom, family, legacy, or peace of mind? A strong ‘why’ acts as your internal motivator when discipline wavers.

2. Embrace Small, Consistent Wins

The biggest enemy of consistency is aiming too high, too soon. Instead of a grueling 2-hour workout, commit to 15 minutes. Instead of a complete financial overhaul, start with tracking expenses for a week. These small, achievable tasks build momentum and rewire your brain to associate progress with positive feelings, making the next step easier.

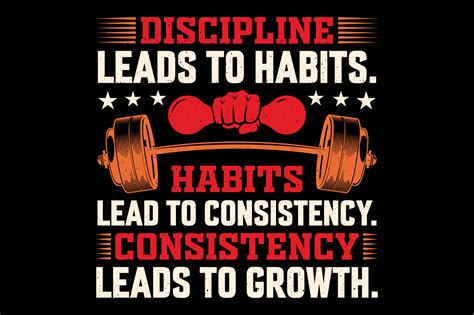

3. Prioritize Discipline Over Motivation

Motivation is fleeting; discipline is enduring. Understand that you won’t always feel like doing what’s necessary. Build habits that become non-negotiable. Schedule your workouts like important meetings. Set up automatic transfers for savings. Discipline is the muscle you build through consistent, deliberate action, even when enthusiasm is low.

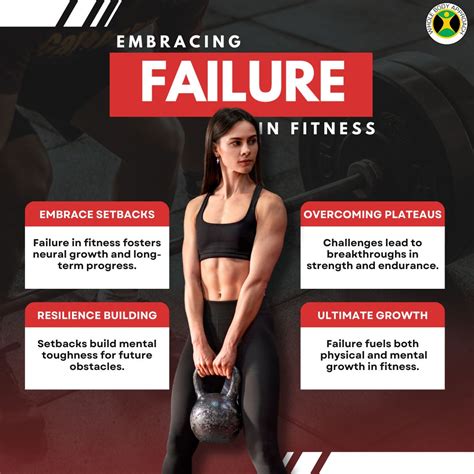

4. Practice Self-Compassion and Resilience

You will have off days. You will miss a workout or overspend. The key isn’t to be perfect, but to be resilient. Instead of self-criticism, acknowledge the setback, learn from it, and get back on track immediately. View failures as data points, not destiny. Your progress isn’t linear; it’s a journey of continuous adjustment.

Practical Strategies for Consistent Fitness

- Schedule It: Block out specific times in your calendar for workouts. Treat them as unmissable appointments.

- Start Small: Begin with manageable routines (e.g., 3 days a week, 30 minutes). Gradually increase intensity or duration.

- Find Your Enjoyment: Experiment with different types of exercise. If you hate the gym, try hiking, sports, or martial arts.

- Accountability: Share your goals with a friend, join a class, or hire a trainer. External commitment can be a powerful motivator.

Practical Strategies for Consistent Finance

- Automate Everything: Set up automatic transfers to savings, investments, and bill payments. Remove the decision-making step.

- Create a Simple Budget: Understand where your money goes. A simple “spend, save, invest” rule (e.g., 50/30/20) can be a great starting point.

- Educate Yourself Regularly: Dedicate time each week to learn about personal finance, even if it’s just 15 minutes. Knowledge builds confidence and reduces anxiety.

- Set Clear, Attainable Goals: “Save $X for Y by Z date.” Specificity fuels action.

The Synergy of Fitness and Finance

The principles for consistency in fitness and finance are remarkably similar. Both require:

- Long-Term Vision: Understanding that today’s small actions lead to significant future results.

- Discipline and Habit Formation: Building routines that operate on autopilot.

- Tolerance for Discomfort: Pushing through tough workouts or making tough financial choices.

- Continuous Learning and Adaptation: Adjusting strategies as circumstances change.

When you cultivate a disciplined approach in one area, it often spills over into others, creating a virtuous cycle of self-improvement and progress.

Conclusion

Overcoming procrastination and building a mindset for consistent fitness and finance isn’t about grand gestures; it’s about making deliberate, small choices daily that align with your long-term vision. By understanding the psychological traps of procrastination, defining your ‘why,’ embracing small wins, prioritizing discipline, and practicing self-compassion, you can forge the mental fortitude necessary for lasting success. Start today, commit to consistency, and watch as your physical well-being and financial future transform.