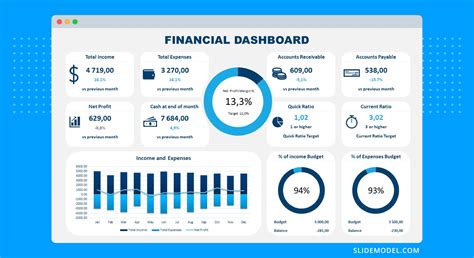

The Modern Man’s Financial Conundrum

For many men, the path to financial security is often fraught with critical decisions, none more pressing than whether to aggressively tackle existing debt or prioritize long-term retirement savings. This isn’t a one-size-fits-all answer, and the optimal strategy often hinges on individual circumstances, financial goals, and risk tolerance. Understanding the unique pressures and opportunities can help men make informed choices that build lasting wealth and financial peace of mind.

The Case for Aggressive Debt Repayment

There’s a strong psychological and financial argument for aggressively paying down debt. High-interest debts like credit card balances or personal loans can act as a significant drag on financial progress, eroding wealth with every passing month. Eliminating these debts can free up substantial cash flow, reduce stress, and provide a sense of liberation. For some, the mental clarity and increased financial flexibility gained from being debt-free outweigh the potential growth of early retirement contributions, especially if the debt interest rates exceed expected investment returns.

Furthermore, tackling consumer debt can improve your credit score, making future loans (like mortgages or car loans) more affordable. The “debt avalanche” method, prioritizing debts with the highest interest rates, is a mathematically sound strategy for minimizing the total interest paid and accelerating the repayment process.

The Power of Retirement Savings

Conversely, the immense power of compound interest makes a compelling case for prioritizing retirement savings, especially early in a career. Every dollar saved today has decades to grow, potentially multiplying many times over. Missing out on employer matching contributions in a 401(k) or similar plan is essentially leaving free money on the table – an immediate 50% or 100% return on your investment that no debt repayment strategy can rival. These contributions are a critical component of wealth building and often the cornerstone of a secure retirement.

Delaying retirement savings can lead to a significant shortfall later in life, requiring much larger contributions to catch up. The younger you start, the less you have to save overall to reach your retirement goals. This long-term perspective is vital for men planning their future security and legacy.

Finding Your Balance: A Strategic Approach

Often, the most effective strategy isn’t an “either/or” but a “both/and” approach, carefully balancing debt repayment with retirement savings. A good starting point for many men is to establish an emergency fund (3-6 months of living expenses) and then contribute at least enough to their employer-sponsored retirement plan to capture the full company match. This ensures you aren’t leaving free money on the table while still building a safety net.

After securing the match and an emergency fund, the decision often comes down to the interest rates on your debts. If you have high-interest debt (e.g., credit cards over 8-10% APR), aggressively paying that down typically yields a guaranteed “return” equivalent to the interest rate, which often outperforms average market returns and offers significant peace of mind. For lower-interest debts like student loans or mortgages, a more balanced approach might be prudent, where you continue to contribute to retirement while making extra payments on debt.

When to Prioritize Which

Your life stage and specific financial situation play a crucial role. A young man just starting his career might prioritize capturing the 401(k) match and then aggressively tackle student loans. A man in his 40s with a stable career and high-interest consumer debt might shift focus to eliminate that debt before supercharging retirement contributions. Mortgage debt, often considered “good debt” due to its lower interest rates and tax deductibility, can often be paid down more gradually while still funding retirement.

Consider your personal comfort level with debt. If carrying debt causes significant stress, paying it down aggressively might be the best choice for your mental well-being, even if the pure mathematical return isn’t as high as investing. Conversely, if you’re comfortable managing lower-interest debt, leveraging time for investment growth could be more beneficial.

Making the Right Call for Your Future

Ultimately, the decision to prioritize aggressive debt repayment versus retirement savings for men requires a thoughtful analysis of individual circumstances, financial goals, and risk tolerance. There’s no single universal answer, but by understanding the pros and cons of each approach, securing employer matches, building an emergency fund, and addressing high-interest debt first, men can forge a robust financial strategy that leads to long-term security and freedom. Consulting a financial advisor can also provide personalized guidance tailored to your unique situation.