Taking Control: Your Path to Financial Freedom

In today’s fast-paced world, managing finances can feel like a relentless uphill battle, especially with the weight of debt and the desire to secure a prosperous future. For men, taking charge of their money isn’t just about balancing a checkbook; it’s about empowerment, security, and building a legacy. This guide will equip you with practical, actionable strategies to optimize your budget, crush existing debt, and accelerate your journey toward significant wealth accumulation.

Step 1: Understand Your Financial Battlefield

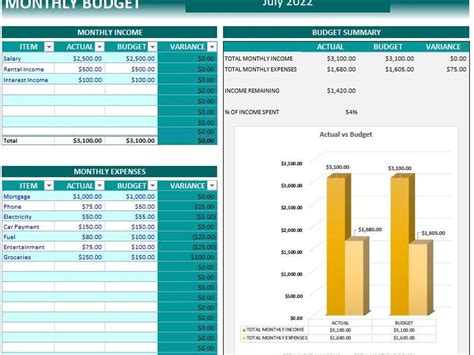

Before you can conquer, you must survey the land. The first crucial step is to gain absolute clarity on your current financial situation. This means tracking every dollar that comes in and every dollar that goes out.

- Income Assessment: List all sources of income, including your primary salary, side hustles, and any passive income.

- Expense Tracking: Categorize your spending for at least one month. Use budgeting apps, spreadsheets, or even a simple notebook. Differentiate between fixed expenses (rent, loan payments) and variable expenses (groceries, entertainment).

- Identify Money Leaks: Pinpoint where your money disappears unnecessarily. Are you spending too much on impulse buys, unused subscriptions, or excessive dining out? These are your primary targets for optimization.

Step 2: Strategic Debt Annihilation

Debt is an anchor that prevents your wealth-building ship from sailing. Eliminating it should be a top priority. Not all debt is created equal, so a strategic approach is essential.

- Prioritize High-Interest Debt: Credit card debt, personal loans, and payday loans often carry exorbitant interest rates. Focus on these first, as they cost you the most over time.

- Choose Your Attack Method:

- Debt Avalanche: Tackle debts with the highest interest rates first. This method saves you the most money in interest over time.

- Debt Snowball: Start by paying off your smallest debt first, regardless of interest rate. The psychological wins can keep you motivated. Choose the method that best suits your personality and keeps you consistent.

- Consider Debt Consolidation: If you have multiple high-interest debts, consolidating them into a single loan with a lower interest rate can simplify payments and reduce your overall cost.

- Negotiate with Creditors: Don’t be afraid to call your creditors and ask for lower interest rates or payment plans, especially if you have a good payment history.

Step 3: Optimize Your Budget for Maximum Impact

Once you understand your money and have a debt plan, it’s time to fine-tune your budget to ensure every dollar works harder for you.

- Needs vs. Wants: Be ruthless in distinguishing between essentials (housing, food, utilities, transportation) and non-essentials (subscriptions, new gadgets, expensive hobbies). Redirect funds from wants to debt repayment or savings.

- Automate Your Finances: Set up automatic transfers for savings, investments, and debt payments immediately after payday. This “pay yourself first” approach ensures you prioritize your financial goals before discretionary spending.

- Cost-Cutting Categories:

- Food: Meal prep, cook at home more often, reduce dining out.

- Transportation: Carpool, use public transport, or walk/bike when possible.

- Entertainment: Look for free or low-cost activities. Re-evaluate unused subscriptions.

- The 50/30/20 Rule: A popular budgeting guideline suggests allocating 50% of your income to needs, 30% to wants, and 20% to savings and debt repayment. Adjust these percentages to fit your specific goals.

Step 4: Accelerate Your Wealth Building Journey

With debt under control and a lean budget, you’re ready to shift gears and accelerate your wealth accumulation.

- Build a Robust Emergency Fund: Aim for 3-6 months’ worth of living expenses saved in an easily accessible, high-yield savings account. This safety net prevents future debt in case of unexpected events.

- Invest Early and Consistently:

- Retirement Accounts: Maximize contributions to employer-sponsored plans (401k, 403b) especially if there’s a company match – that’s free money! Also, contribute to an Individual Retirement Account (IRA) like a Roth IRA for tax-advantaged growth.

- Diversify Your Investments: Don’t put all your eggs in one basket. Invest in a mix of stocks, bonds, mutual funds, and ETFs suitable for your risk tolerance and long-term goals.

- Consider a Brokerage Account: For investments beyond retirement accounts, a taxable brokerage account offers flexibility.

- Explore Passive Income Streams: Look for opportunities to earn money that doesn’t require active daily involvement, such as rental properties, dividend stocks, high-yield savings accounts, or creating digital products.

Step 5: Maintain Momentum and Adapt

Financial optimization isn’t a one-time event; it’s an ongoing process. Regular review and adaptation are key to long-term success.

- Regular Financial Reviews: Schedule monthly or quarterly check-ins to review your budget, track progress on debt, and assess your investment performance.

- Educate Yourself Continuously: The financial landscape changes. Stay informed about market trends, new investment opportunities, and tax law changes. Read books, listen to podcasts, and follow reputable financial experts.

- Set New Goals: As you achieve one financial milestone, set the next. Whether it’s saving for a down payment, funding a child’s education, or early retirement, clear goals keep you motivated.

Conclusion: Your Financial Future Awaits

Optimizing your budget to crush debt and accelerate wealth building is a journey that requires discipline, consistency, and a clear vision. By understanding your finances, strategically eliminating debt, making smart budgeting choices, and investing wisely, you’re not just managing money – you’re building a foundation for a life of financial security, freedom, and opportunity. Take the first step today; your future self will thank you.