Understanding Peak Earning Capacity

The concept of ‘peak earning capacity’ refers to the point in an individual’s career when their income potential is at its highest. For many, this represents a culmination of experience, specialized skills, professional networks, and career advancement. While it’s a general metric, understanding this peak can be crucial for financial planning, career development, and retirement strategies.

For men in their primary career fields, this pinnacle of income is often reached after years of dedicated work and skill development. It’s a phase where their market value is optimized, balancing their accumulated expertise with remaining years in the workforce before retirement is typically considered.

The Typical Age Range for Men

While there can be variations, economic studies and labor market analyses generally indicate that men in their primary career fields tend to reach their peak earning capacity between the ages of late 40s and early 50s. More specifically, data often points to a range spanning from roughly 45 to 55 years old, with many sources highlighting the early 50s as a common sweet spot.

This age range allows for sufficient time to gain senior-level experience, often move into management or executive roles, and command higher salaries based on a proven track record. By this point, most men have completed their advanced education, established a strong professional reputation, and navigated several career advancements.

Factors Influencing the Earning Peak

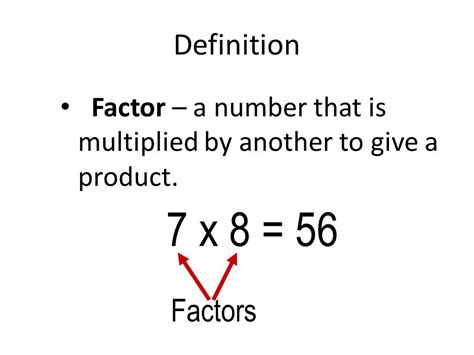

Several critical factors contribute to when and how high a man’s earning capacity will peak:

- Industry and Occupation: Fields requiring extensive education and experience, like medicine, law, or specialized engineering, may see later peaks (late 50s or even 60s). Conversely, fast-paced industries like tech, where innovation is key, might see slightly earlier peaks (late 30s to early 40s) for certain roles, though management and leadership roles still often peak later.

- Education and Specialization: Higher levels of education (Master’s, Ph.D., professional degrees) often lead to higher earning potential and can sometimes push the peak age slightly later as more time is spent in schooling and initial career development.

- Geographic Location: Earning potential and peak ages can vary significantly by region or country due to different economic conditions, cost of living, and industry concentrations.

- Economic Conditions: Broader economic trends, recessions, or booms can impact salary growth and the timing of peak earnings.

- Continuous Learning and Adaptation: Men who continually update their skills and adapt to new technologies or market demands are more likely to sustain and maximize their earning capacity for longer.

Beyond the Peak: Sustaining and Planning

It’s important to note that reaching a ‘peak’ does not mean earnings immediately decline. For many, income can remain stable or even see modest increases for several years after the initial peak. The decline, if it occurs, is often gradual and might be influenced by factors such as a desire for less demanding roles, a shift towards part-time work, or the natural progression towards retirement.

For those nearing or at their peak, this period is often critical for aggressive savings, investment, and strategic financial planning. Maximizing this high-earning phase can significantly impact long-term financial security and retirement readiness.

Conclusion

While individual experiences will always vary, the general consensus points to men typically reaching their peak earning capacity in their primary career fields between their late 40s and early 50s. This period reflects a blend of accumulated experience, specialized knowledge, and professional standing. Understanding this typical trajectory can empower men to make informed career decisions, strategically plan for their financial future, and ensure they capitalize on their most lucrative professional years.