Achieving significant milestones in both fitness and finance often hinges on one crucial trait: unshakeable discipline. It’s not about fleeting motivation, but about the consistent, often unglamorous, effort put in day after day. Building this mental fortitude is a skill, not an innate quality, and it can be cultivated with the right strategies and mindset.

Understanding Unshakeable Discipline

Discipline is the bridge between goals and accomplishment. It’s the ability to make yourself do what needs to be done, even when you don’t feel like doing it. For fitness, this might mean sticking to your workout plan even when tired. For finance, it’s about consistently saving or investing, even when immediate gratification beckons.

True discipline isn’t about brute force; it’s about setting up systems and mental models that make the desired actions easier and the undesired actions harder. It’s about prioritizing long-term rewards over short-term pleasures.

Core Principles for Building Unshakeable Discipline

1. Set Clear, Meaningful Goals

Vague goals lead to vague efforts. Define what you want to achieve with absolute clarity. For fitness, this could be ‘run a 10K in X time’ or ‘lose Y kg by Z date.’ For finance, it might be ‘save $A for a down payment by B month’ or ‘pay off $C in debt.’ Crucially, connect these goals to your deeper ‘why’ – your core values and aspirations. This intrinsic motivation fuels your discipline when external motivation wanes.

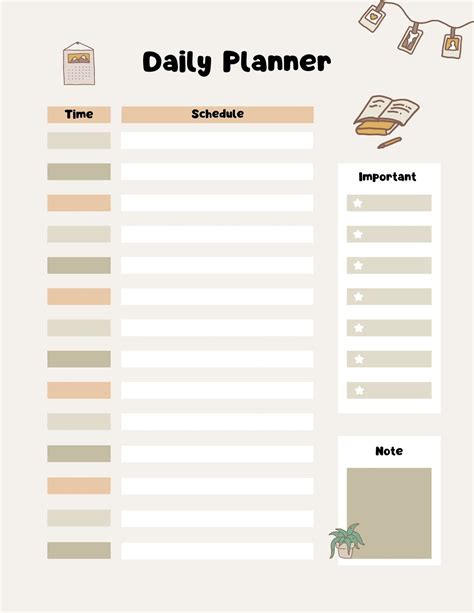

2. Develop Consistent Routines and Habits

Discipline thrives on routine. Instead of relying on willpower, which is a finite resource, build habits that automate your desired actions. Start small: a 15-minute walk daily, or reviewing your budget for 10 minutes each Sunday. Consistency over time turns these small actions into powerful, ingrained habits. Make the behavior as frictionless as possible.

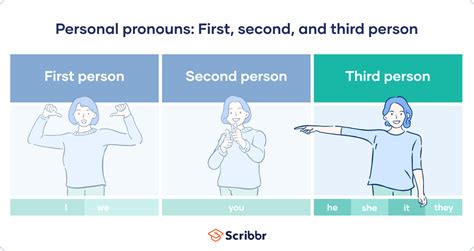

3. Master Self-Control and Delayed Gratification

This is the bedrock of discipline. Practice resisting immediate temptations for greater future rewards. This could involve choosing a healthy meal over fast food, or saving money instead of buying the latest gadget. Recognize the triggers that lead to impulsive decisions and develop strategies to circumvent them. Mindfulness practices can significantly enhance your ability to observe impulses without acting on them.

4. Create an Accountability System

You don’t have to build discipline alone. Share your goals with a trusted friend, family member, or mentor. Join a fitness group or find a financial accountability partner. Regular check-ins can provide the external push needed when your internal drive falters. Tracking your progress visibly (e.g., a habit tracker, budget spreadsheet) also serves as a powerful form of self-accountability.

5. Learn from Setbacks and Adapt

No one is perfectly disciplined all the time. You will miss workouts, overspend, or deviate from your plan. The key to unshakeable discipline isn’t avoiding failure, but how you respond to it. Instead of self-criticism, analyze what went wrong, adjust your strategy, and get back on track immediately. View setbacks as data points, not as reasons to give up.

Applying Discipline to Fitness Goals

- Schedule Your Workouts: Treat your exercise time like non-negotiable appointments.

- Meal Prep: Prepare healthy meals in advance to avoid impulsive unhealthy food choices.

- Find an Enjoyable Activity: You’re more likely to stick with something you genuinely like.

- Progressive Overload: Continuously challenge yourself slightly to prevent plateaus and maintain engagement.

Applying Discipline to Finance Goals

- Automate Savings: Set up automatic transfers to your savings or investment accounts immediately after payday.

- Track Spending: Know where your money goes. A budget is a roadmap for your financial discipline.

- Avoid Lifestyle Creep: As your income increases, resist the urge to immediately inflate your expenses.

- Educate Yourself: Understanding financial principles strengthens your resolve to make smart choices.

Conclusion

Unshakeable discipline isn’t about being perfect; it’s about being persistent. By setting clear goals, building strong habits, practicing self-control, leveraging accountability, and learning from your missteps, you can systematically cultivate the discipline needed to transform your fitness and financial aspirations into tangible realities. Start small, stay consistent, and watch your ability to achieve grow.