Achieving sustained success in both fitness and finance often feels like an uphill battle. We start strong, full of motivation, only to encounter plateaus, unexpected expenses, or simply a dip in enthusiasm. The secret to pushing through these inevitable challenges isn’t just about willpower; it’s about cultivating a resilient mindset – a mental framework that allows you to bounce back, adapt, and stay consistent.

Understanding Resilience: The Core of Consistent Action

Resilience is the capacity to recover quickly from difficulties; toughness. In the context of fitness, it means getting back on track after a missed workout, an injury, or a less-than-ideal eating day. For finance, it’s about adjusting your budget after an unexpected expense, recovering from an investment loss, or sticking to savings goals despite temptations. Without resilience, minor setbacks can derail your entire journey.

The Interconnectedness of Fitness and Finance Discipline

Surprisingly, the discipline required for physical well-being often mirrors that needed for financial health. Both demand long-term vision, delayed gratification, consistent effort, and a willingness to learn from mistakes. Building a habit in one area can often transfer valuable lessons and strengthen your mental fortitude for the other. For instance, the patience learned during a strength training program can be applied to waiting for investments to grow.

Key Pillars for Building a Resilient Mindset

1. Embrace Setbacks as Learning Opportunities

Instead of viewing a missed gym session or an overspending incident as a failure, see it as data. What led to it? What can you learn? This shift in perspective prevents guilt from spiraling into complete abandonment. Analyze the situation, adjust your strategy, and move forward.

2. Set Realistic, Incremental Goals

Overly ambitious goals can lead to burnout and discouragement. Break down your fitness and finance aspirations into smaller, manageable steps. Celebrate small victories along the way. This builds momentum and reinforces your belief in your ability to achieve larger objectives.

3. Develop Strong Self-Awareness

Understand your triggers, your energy levels, and your financial habits. When are you most likely to skip a workout? When are you prone to impulse buying? Recognizing these patterns allows you to proactively implement strategies to counter them. Self-reflection through journaling can be a powerful tool here.

4. Cultivate Positive Self-Talk and Visualization

Your inner dialogue profoundly impacts your resilience. Challenge negative thoughts and replace them with empowering affirmations. Visualize yourself consistently hitting your fitness goals or reaching financial milestones. This mental rehearsal can build confidence and prepare you for challenges.

5. Build Robust Routines and Habits

Consistency is key. Establish non-negotiable routines for your workouts, meal prep, budget reviews, and savings transfers. When these actions become habits, they require less willpower and are more likely to persist even when motivation wanes.

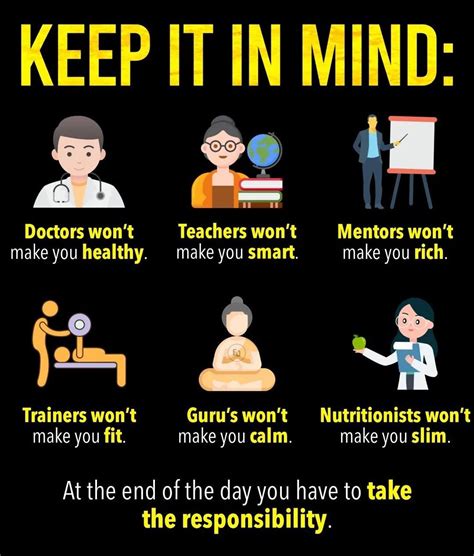

6. Seek Support and Accountability

You don’t have to go it alone. Share your goals with a trusted friend, family member, or mentor. Join a fitness community or a financial planning group. External accountability can provide the extra push you need when your internal motivation falters.

Actionable Strategies for Daily Resilience

- Mindfulness and Stress Management: Practices like meditation or deep breathing can help you stay calm under pressure and make more rational decisions in both domains.

- Regular Reviews: Schedule weekly check-ins for your fitness progress (e.g., workout logs) and financial status (e.g., budget review, investment tracking). Adjust as needed.

- Prioritize Recovery: Just as your muscles need rest, your finances need a buffer. Build an emergency fund to absorb unexpected shocks, preventing financial setbacks from derailing your long-term plans.

Conclusion: Your Journey to Unwavering Progress

Cultivating a resilient mindset is not about never failing; it’s about building the capacity to persist and adapt when you do. By embracing setbacks, setting smart goals, fostering self-awareness, positive self-talk, strong routines, and seeking support, you equip yourself with the mental fortitude needed for consistent action. Start small, be patient with yourself, and watch as your resilience transforms your fitness journey and financial future.