Why a Budget Isn’t Just for Accountants (or Your Spouse)

For many men, the word “budget” conjures images of restrictive spreadsheets or giving up everything enjoyable. But in reality, a practical budget is your roadmap to financial freedom, giving you control, reducing stress, and unlocking opportunities you never thought possible – from buying a house to early retirement. It’s about being intentional with your money, not deprived by it. Let’s break down a no-nonsense plan to get your finances in top shape.

Taking command of your money is a powerful act of self-reliance and responsibility. It means understanding where every dollar goes, making conscious choices, and setting yourself up for long-term success. This isn’t about being cheap; it’s about being strategic and building a financial fortress for yourself and your future.

Step 1: The Financial Blueprint – Know Your Numbers

You can’t win a game if you don’t know the score. The first and most critical step is to get a clear picture of your income and expenses.

- Income: Tally up all your take-home pay from your primary job, side gigs, investments – everything that comes in consistently each month.

- Fixed Expenses: These are your non-negotiables that are roughly the same every month: rent/mortgage, loan payments (car, student, personal), insurance premiums, subscriptions (gym, streaming).

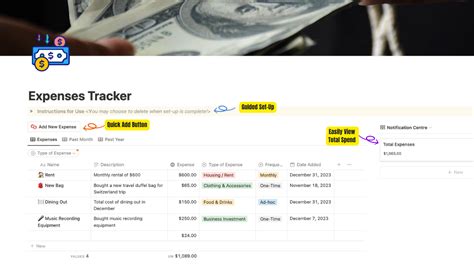

- Variable Expenses: This is where it gets interesting. Track everything else: groceries, dining out, entertainment, gas, shopping, hobbies, personal care. Use a budgeting app (like Mint, YNAB, or a simple spreadsheet) to track every dollar spent for at least one full month. This step is crucial for identifying leaks.

Step 2: The Ruthless Trim – Identifying & Cutting Unnecessary Spending

Once you see where your money goes, you’ll likely find categories where you’re overspending without even realizing it. This is your opportunity to reallocate those funds towards saving and debt repayment.

- Analyze and Cut: Look at your variable expenses. Can you cook more at home instead of eating out? Do you really need all those streaming services? Are impulse purchases draining your wallet? Be honest with yourself.

- The “No-Spend” Challenge: Try a weekly or monthly “no-spend” challenge where you only pay for absolute necessities. It’s an eye-opening exercise that forces creativity and highlights wasteful habits.

- Negotiate Bills: Call your internet, cable, and even insurance providers to see if you can get a better rate. Loyalty often pays off, but only if you ask.

Step 3: Automate Your Ascent – Savings & Debt Payments on Autopilot

The easiest way to stick to a budget and achieve financial goals is to remove willpower from the equation. Automate your financial success.

- Automate Savings: Set up an automatic transfer from your checking to your savings account (or investment account) every payday. Start with 10% of your income, but aim higher. Pay yourself first.

- Automate Debt Payments: Set up automatic payments for all your debts. For extra impact, set up an additional transfer to your highest-priority debt (see Step 4) that goes out immediately after your paycheck hits.

- Emergency Fund: Before aggressively tackling debt, aim for a starter emergency fund of $1,000-$2,000. This prevents new debt from derailing your progress when unexpected expenses pop up.

Step 4: The Debt Offensive – Strategy & Execution

Crushing debt requires a focused strategy. The two most popular methods are the Debt Snowball and Debt Avalanche.

- Debt Snowball: List your debts from smallest balance to largest. Pay minimums on all but the smallest debt, on which you throw every extra dollar. Once the smallest is paid off, take the money you were paying on it (minimum + extra) and apply it to the next smallest. This method provides psychological wins.

- Debt Avalanche: List your debts from highest interest rate to lowest. Pay minimums on all but the highest interest debt, on which you throw every extra dollar. This method saves you the most money on interest in the long run.

- Pick one and stick to it. Consistency is key. Every extra dollar you can free up from Step 2 should be funneled directly into your chosen debt repayment strategy.

Step 5: Stay Resilient & Adapt – Your Budget is a Living Document

A budget isn’t a one-and-done task; it’s an ongoing process. Life happens, and your budget needs to adapt.

- Regular Reviews: Set aside time once a month (or at least quarterly) to review your budget. How did you do? Did you stick to your limits? Are there new expenses or income changes? Adjust categories as needed.

- Celebrate Wins: Acknowledge your progress! Paid off a credit card? Hit a savings milestone? Celebrate responsibly (without derailing your budget, of course). Positive reinforcement keeps you motivated.

- Learn and Grow: Educate yourself about investing, retirement planning, and wealth building. As you crush debt and build savings, your financial focus will shift from survival to thriving.

Implementing a practical budget plan is one of the most empowering things you can do for yourself. It’s not about giving up what you love; it’s about making conscious choices that align with your long-term goals. By consistently knowing your numbers, trimming unnecessary spending, automating your finances, strategically attacking debt, and regularly reviewing your plan, you’ll not only save more and crush debt but also build a solid foundation for true financial independence.